If you’re wondering how to buy life insurance, we can help! We’ll explain the whole process below, since a lot goes on behind the scenes. Did you know that every life insurance policy is priced based on your unique age, health history, and lifestyle? The process begins when you get a quote and give us a little information about yourself. Once we know a little about you, we can source policy quotes from over 60 of the country’s top insurers. Here’s what we’ll cover:

Step 1: Decide What Type of Coverage You Want

Step 2: Get a Free Quote

Step 3: Submit Your Application

Step 4: Complete the Underwriting Process

Step 5: Put Your Policy in Force

➡️ Want to talk to a real person before you buy? Smart move! Call us at (800) 823-4852 and we’ll answer any questions you have, or click the button below to start with a free term life quote.

Get a Free QuoteStep 1: Decide What Type of Coverage You Want

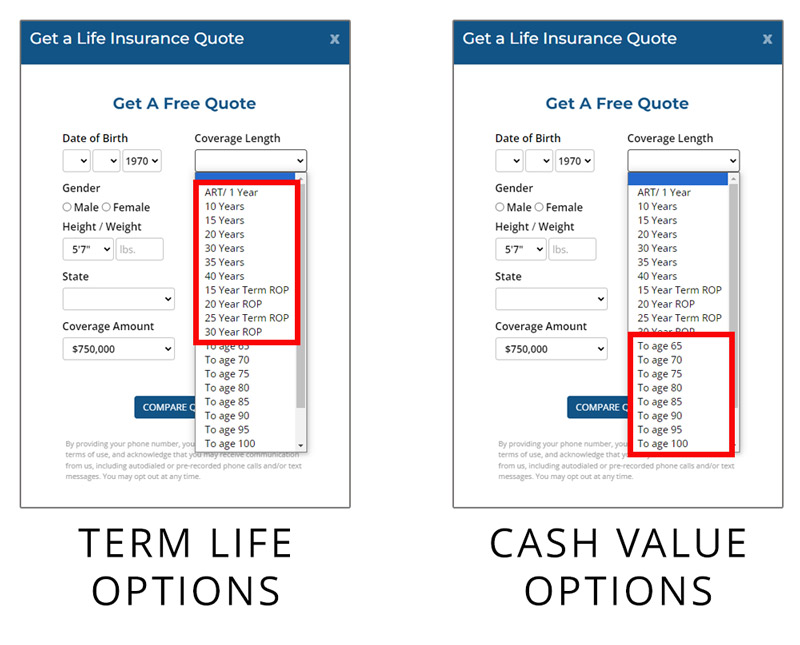

The first step in learning how to buy life insurance is deciding which type of policy you want to buy. Think of it like buying a car: you have a lot options! There are two main types of coverage: term life and cash value. You’ll need to know which type you want before you get a quote. Here are the main differences to help you decide:

- Term Life: The most popular and affordable type of coverage available! You’ll select a term that covers the length of your financial obligations – until the kids are grown, until retirement, or until the mortgage is paid off, for example. Terms range from one-year-renewable terms to 40 years. Because there’s an expiration date, this coverage is very affordable. Most of our clients opt for term coverage because it’s simple, easy, and affordable.

- Cash Value: This coverage doesn’t have an expiration date. Instead of a term, you choose an age at which the coverage “matures.” If you’re still alive when the policy matures, the insurance company pays you the death benefit. These policies also contain a cash value account, which is like a savings component. It grows over time, funded partially by your payments and partially by interest paid by your insurer. There are multiple types of cash value policies, with differences in the amount of interest paid and how that interest is calculated. You can learn about the different types here. If you decide you want a cash value policy, it’s best to work with an agent who can answer your questions about the differences between these policy types.

➡️ Want to talk to a real person about how to buy life insurance? We’re here for you! Call us at (800) 823-4852 and let us walk you through the process, making it easy and stress-free. You can also click the button below to start with a free term life quote:

Get a Free QuoteStep 2: Get a Free Quote

There are two ways to get a free quote: use our free online quoter, or talk to one of our licensed life insurance agents. Our quoter can give you rates for two policy types: term and universal life (a form of cash value life insurance). If you’re interested in another policy type (whole, indexed universal, or variable universal life), please give us a call at (800) 823-4852 and we’ll give you rates over the phone or email them to you.

Once you get your quotes, it’s up to you choose the policy that best meets your needs from the list you see. We recommend getting quotes for a variety of policies – play around with term length, or increase or decrease the amount of coverage. See how that changes the price so you have a good feel for how much coverage you can comfortably afford.

Here are some more things to consider while you’re choosing a policy:

- Does the insurer have good financial ratings?

- Does the insurer have good customer reviews?

- Are you interested in adding extra benefits to your policy, such as: coverage for your children (via a child rider) or disability or long-term care coverage (via additional riders)? If so, give us a call at (800) 823-4852 and we can look up which riders are available for the policies you’re considering.

Keep in mind that the quotes you have at this point are estimates. It’s possible those prices might change during the underwriting process (step 4, explained below). That’s why the next step is to apply for the policy, and give the insurance company the information they need to evaluate how much it will actually cost to insure you. So let’s move on to submit that application!

➡️ Want to talk to our licensed agents about how to buy life insurance? We’re here for you! Call us at (800) 823-4852 and let us walk you through the process, making it easy and stress-free. You can also click the button below to start with a free term life quote:

Get a Free QuoteStep 3: Submit Your Application

At WholesaleInsurance.net, we guide you through the entire application process. After you get a quote, we’ll contact you to complete and submit your application. The insurer will have a list of questions for us to ask you – and we’ll fill those answers into the application for you.

The insurer’s questions will be about your health history and lifestyle. The insurer will want to know, for example, if you’re taking any prescription medications. They’ll also request that we fill out a form with your permission to look at your medical records, so they can get a more complete picture of your health. The life insurance process comes with paperwork, it’s true! But we’re here to handle all of that for you, so it’s as quick as possible on your end.

When the application is complete, we’ll email it to you for your digital eSignature. Don’t worry - we’ll walk you through the entire process, even if you’re not tech-savvy. We can also send you a paper application to sign, if needed. Once your application is complete, we’ll submit it to the insurer for you.

➡️ Want to talk to a real person about how to buy life insurance? We’re here for you! Call us at (800) 823-4852 and let us walk you through the process, making it easy and stress-free. You can also click the button below to start with a free term life quote:

Get a Free QuoteStep 4: Complete the Underwriting Process

The underwriting process happens while the insurer evaluates your application. To do this, they’ll look at the answers you supplied during our phone interview, review your medical records, and depending on the policy and insurer you chose, look at the results of your medical exam.

Some policies require you to take a free life insurance medical exam. If your insurer requires this, we’ll handle all the scheduling for you when we complete your application. Although it might not sound like fun, the exam can actually make your coverage less expensive! Policies with an exam (called “full medical underwriting” in life-insurance speak) are cheaper than policies where the insurer doesn’t have this information about your current health.

The life insurance medical exam is pretty simple – a mobile medic will come to your home or office, whenever it’s convenient for you. They’ll measure your height and weight, as well as collect a blood and urine sample. With this information, the insurer can tell how much of a risk you might be to insure, and can assign you a rate class. A rate class is what tells them how much it would cost to insure you, and what they use to set the final price of your coverage.

Don’t want to bother with an exam? You don’t have to! We can get you quotes for no-exam policies, which don’t require a medical exam. Instead, the insurer will look you up in national databases to gather information about you, including your driving record and prescription history. The trade-off is that non-med policies usually cost more than fully underwritten policies. It’s up to you!

We’ll be in touch with you during the underwriting process to let you know if the insurer needs any more information. If you chose a non-med exam, underwriting happens quickly – instantly, in some cases. If you chose a fully underwritten policy with an exam, the underwriting process can take 4-6 weeks. But you’ll never have to worry what’s happening – we’ll be in touch to keep you updated throughout the process.

➡️ Want to talk to a licensed agent about how to buy life insurance? We’re here for you! Call us at (800) 823-4852 and let us walk you through the process, making it easy and stress-free. You can also click the button below to start with a free term life quote:

Get a Free QuoteStep 5: Put Your Policy in Force

When the underwriting process is finished, the insurer will get back to us with an offer of coverage and a final rate. This may be different than the initial quote, but it’s based on the underwriting process and the rate class selected by the insurer. In most cases, it’s pretty close to the original quote.

Why would the final rate offered be different than your quote? Well, in rare cases, the medical exam or a close look at your medical records may turn up health issues that make you more of a risk to cover. If that happens, you’re not obligated to accept the policy at that higher price – it’s still up to you to choose whether you want to finalize your purchase. This is also why it’s important to disclose everything about your health (including prescriptions you’re taking, or any tobacco or alcohol use) when you apply for coverage. If your exam results or medical records contradict what you said on the application, the insurer may deny you coverage. Don’t risk your loved ones’ financial future! Honesty really is the best policy in this situation.

If everything looks good, there will be a few last pieces of paperwork to complete to put your coverage “in force.” You’ll also need to make the first payment to set things in motion. We’ll also be with you during this step of the process, to answer any last questions and make sure everything is complete.

The last step of the process is for you to tell your beneficiary(ies) about your policy, so they know where to file a claim if anything were to happen to you. Now you have life insurance! Your loved ones are protected, and you’ve earned that peace of mind. Congratulations!

Ready to take your knowledge about how to buy life insurance to the next level with a policy of your own?➡️ Want to talk to a real person before you buy? We’re here for you! Call us at (800) 823-4852 and let us walk you through the process, making it easy and stress-free. You can also click the button below to start with a free term life quote:

Get a Free Quote